Credit cards are among the most widely used financial tools in modern life. They offer unmatched convenience, quick access to credit, and attractive rewards. Yet, beneath the surface of these benefits lies the potential for debt traps that can derail financial stability. Many individuals find themselves burdened by spiraling interest costs and mounting dues simply because they underestimated the discipline required to manage credit cards responsibly. Mastering credit card management is, therefore, not just about swiping freely but about building habits that protect financial well-being.

Understanding the Nature of Credit

The first step in managing a credit card effectively is to truly understand the nature of the money it provides. Unlike a debit card, which spends from your existing bank balance, a credit card extends borrowed money from the issuer. Each purchase, no matter how small, represents a loan that must be repaid. The temptation of “buy now, pay later” can create a false sense of affordability, especially when the credit limit is higher than one’s usual spending capacity. This distinction is critical: when you swipe, you are borrowing, and borrowing always carries a cost if not managed wisely.

The Cost of Carrying a Balance

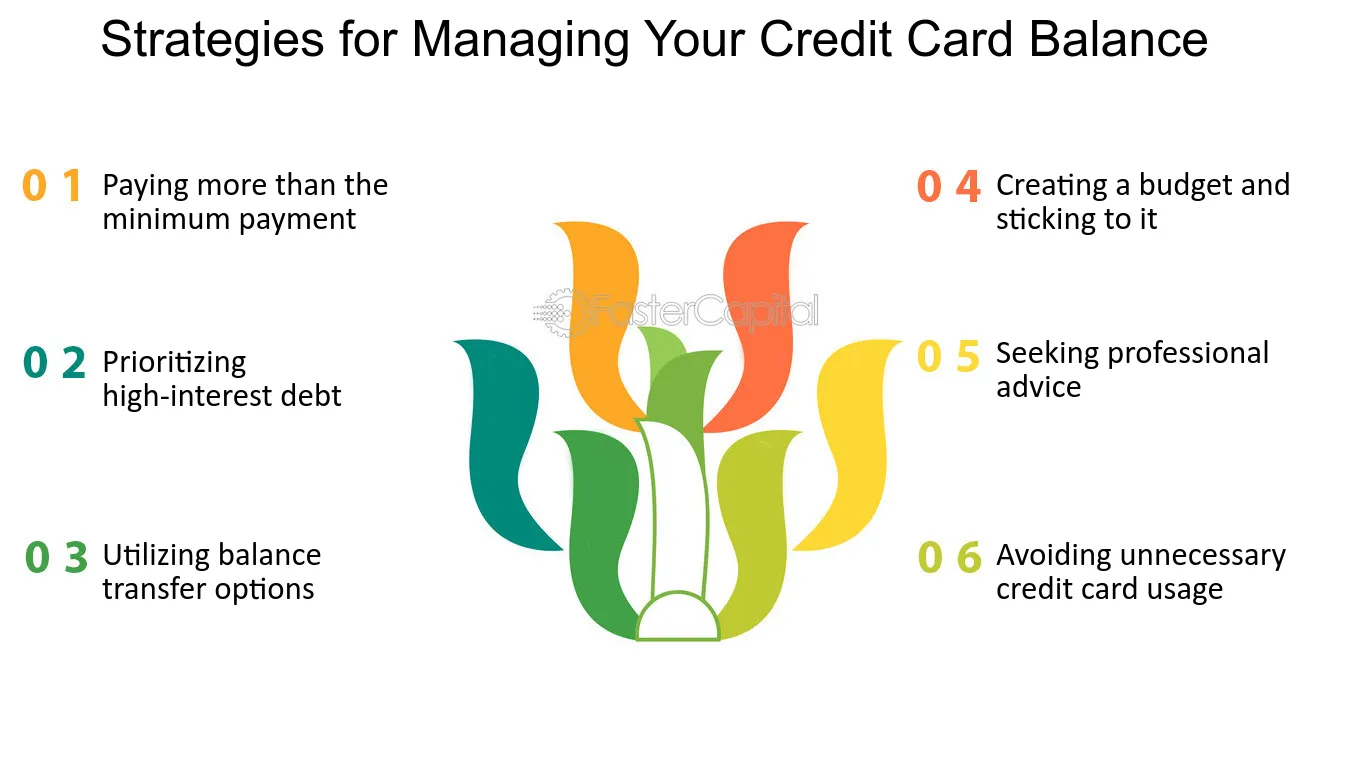

One of the most common ways people fall into debt traps is by carrying unpaid balances from month to month. Credit cards often come with interest rates significantly higher than other forms of borrowing, and when balances are rolled over, the compounding effect can quickly turn a manageable expense into a heavy burden. Even a small amount left unpaid can snowball into an intimidating liability over time. This is why financial advisors emphasize the importance of paying the full outstanding amount before the due date, rather than settling for the minimum payment that only delays the problem while increasing the cost.

Spending With Intention

A crucial aspect of mastering credit card use is approaching spending with intention rather than impulse. Credit cards can blur the line between needs and wants because the payment is deferred. To use them effectively, one must develop the discipline of treating credit as carefully as cash. This means charging only what can realistically be paid off within the billing cycle and resisting the urge to overspend simply because the limit allows it. A cardholder who views the credit limit as a resource to be preserved rather than consumed will avoid the trap of chasing short-term gratification at the expense of long-term financial health.

Rewards Without Regrets

Many people are drawn to credit cards for their reward programs, cashback offers, or loyalty points. While these perks can be valuable, they should never become the reason to spend more than necessary. A common mistake is chasing points by making unnecessary purchases, which ultimately cancels out the benefit of the rewards once interest charges set in. The true advantage of rewards lies in earning them on essential spending that you would have made anyway, such as groceries, fuel, or utility bills, and then paying off the balance in full. Rewards should enhance financial discipline, not justify reckless usage.

Building Credit Health

Proper credit card management also has a long-term impact on your credit score, which is a key factor in securing loans at favorable terms. Consistent on-time payments demonstrate reliability, while overutilizing the credit limit can signal financial strain. Ideally, utilization should remain well below the maximum limit to reflect prudent borrowing behavior. By using a card regularly but responsibly, and clearing dues without fail, cardholders not only avoid debt but also strengthen their ability to access larger financial opportunities such as home loans or business financing.

Recognizing Warning Signs

Debt traps rarely appear overnight; they build gradually through small oversights. Warning signs such as using one credit card to pay off another, relying on cash advances, or consistently carrying balances across cycles indicate that credit management is slipping into risky territory. Awareness of these patterns allows individuals to take corrective action early, whether by cutting back on expenses, consolidating debts, or seeking professional advice. Recognizing when control is being lost is as important as having the discipline to stay on track in the first place.

The Balance Between Convenience and Caution

Ultimately, mastering credit card management is about striking a balance between enjoying the convenience of instant credit and exercising caution to avoid financial stress. A credit card can be an asset that builds creditworthiness and provides valuable flexibility in emergencies. Yet, it requires a mindset rooted in responsibility, where the card serves as a tool rather than a crutch. With thoughtful use, clear repayment strategies, and the awareness that borrowed money always comes with strings attached, one can harness the full benefits of credit cards without falling into the traps that ensnare so many.

Credit cards, when managed wisely, are not enemies of financial stability but allies in achieving it. The key lies in approaching them with respect, discipline, and foresight. By viewing each swipe not as free money but as a commitment to repay, individuals can transform credit cards from potential pitfalls into powerful instruments of financial freedom.