When it comes to managing personal finances in the United States, your credit score plays a role far more significant than just securing a loan. It is a three-digit number that tells lenders how trustworthy you are with borrowing and repaying money. From applying for a mortgage to leasing a car or even securing better insurance rates, your credit score has the power to open doors—or close them. For many people, understanding how this number works and how to improve it feels like an intimidating process. But once broken down, it is quite straightforward.

What Exactly Is a Credit Score?

A credit score is essentially a snapshot of your creditworthiness. The most widely used scoring model is the FICO score, which ranges from 300 to 850. A higher score signals to lenders that you are a lower-risk borrower. The score itself is calculated from data found in your credit report, which is maintained by credit bureaus such as Equifax, Experian, and TransUnion.

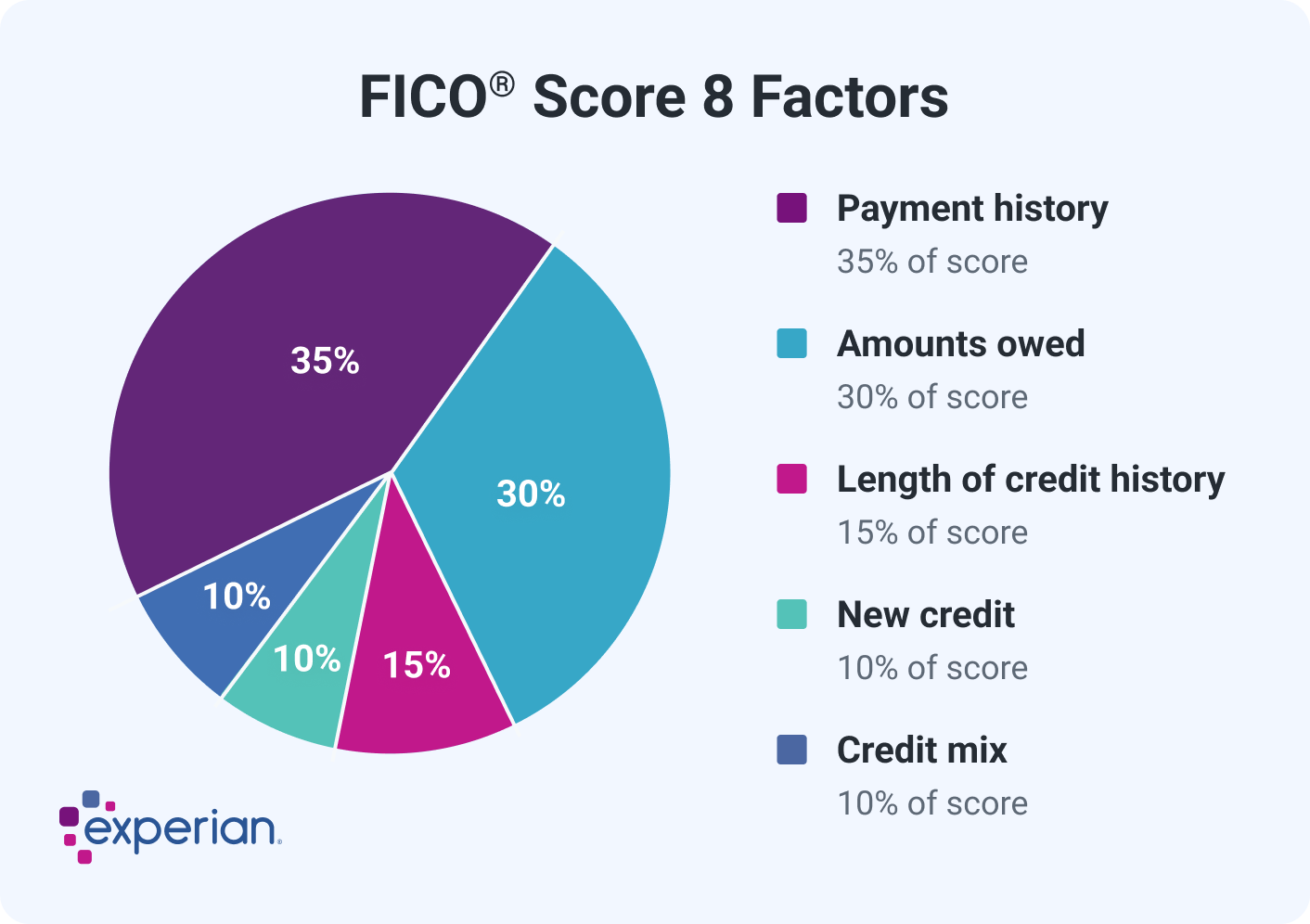

The score takes into account five key factors: payment history, credit utilization (how much of your available credit you are using), length of credit history, new credit inquiries, and credit mix (types of credit such as credit cards, loans, or mortgages). Each of these components contributes differently, but together they form a comprehensive picture of your financial behavior.

Why Does Your Credit Score Matter?

Your credit score is not just about loans—it affects everyday aspects of your financial life. Lenders rely on it when deciding whether to approve you for a mortgage or a personal loan and at what interest rate. A higher score often translates into lower interest rates, which can save you thousands of dollars over the life of a loan.

Beyond lending, landlords often check credit scores to gauge how likely you are to pay rent on time. Insurance companies may use it to calculate premiums. Even some employers review credit reports, especially for roles that involve handling money or sensitive data. Put simply, a strong credit score makes life easier and cheaper, while a poor score creates unnecessary financial hurdles.

How to Improve Your Credit Score

Improving your credit score is not about quick fixes but rather consistent financial discipline. The most important habit is making payments on time. Even one late payment can significantly hurt your score, particularly if it goes unpaid for more than 30 days. Setting up reminders or automatic payments can help ensure you never miss a due date.

Another key factor is your credit utilization ratio. This measures the amount of credit you use relative to your total available credit. For example, if you have a $10,000 credit limit and regularly carry a balance of $5,000, your utilization rate is 50 percent. Lenders generally prefer this ratio to be below 30 percent. Keeping balances low or paying them off in full each month demonstrates financial responsibility.

Length of credit history also plays a role, which means closing old accounts is not always a wise move. Even if you no longer use a particular credit card, keeping it open can help maintain a longer average account age. Similarly, be cautious about applying for multiple new accounts in a short time. Each application triggers a hard inquiry, which can temporarily lower your score.

Finally, a diverse credit mix—such as having both revolving credit (credit cards) and installment credit (auto loans or mortgages)—can help boost your score. That said, don’t take on unnecessary debt simply to diversify. Responsible management of the credit you already have matters more.

Maintaining a Good Credit Score

Once you have improved your score, maintaining it requires steady habits. Responsible borrowing and timely payments remain at the heart of this process. It’s also wise to check your credit reports regularly for errors. Mistakes do happen, such as incorrect account balances or outdated information, and these can unfairly drag your score down. By law, you are entitled to a free credit report from each of the three major bureaus once a year through AnnualCreditReport.com. Reviewing them carefully allows you to dispute inaccuracies.

Another aspect of maintaining your score is practicing restraint with debt. Just because you have a higher credit limit doesn’t mean you should increase your spending. Consistency, rather than sudden changes, keeps your credit profile stable. If you are planning a major loan application, such as for a home, it’s best to avoid opening new accounts or making unusual financial moves in the months leading up to it.

The Long-Term Benefits of a Strong Credit Score

The rewards of maintaining a good credit score compound over time. With a score above 740, you position yourself in the “very good” to “excellent” range, unlocking the best interest rates available. This means that over the course of a 30-year mortgage or a five-year auto loan, you could save tens of thousands of dollars simply because of a strong credit profile.

Additionally, a high credit score provides peace of mind. It ensures that when financial opportunities or challenges arise—whether that means buying your first home, refinancing existing debt, or dealing with an emergency—you have access to credit on favorable terms. It also signals to businesses, landlords, and even employers that you are dependable and financially responsible.

Do’s and Don’ts for Credit Score Management

| Do’s | Why It Matters |

|---|---|

| Pay bills on time | Payment history makes up the largest share of your score and shows reliability. |

| Keep credit utilization below 30% | Using less of your available credit signals responsible borrowing. |

| Check your credit reports annually | Helps catch and dispute errors that could hurt your score. |

| Maintain older accounts | Longer credit history strengthens your score. |

| Use a mix of credit types responsibly | A balanced portfolio (credit cards + loans) demonstrates financial maturity. |

| Don’ts | Why It Matters |

|---|---|

| Don’t miss payments | Even one late payment can cause a major drop in your score. |

| Don’t max out credit cards | High balances relative to limits damage your utilization ratio. |

| Don’t apply for too many new accounts | Each application triggers a hard inquiry, temporarily lowering your score. |

| Don’t close old credit lines unnecessarily | This can shorten your credit history and reduce available credit. |

| Don’t ignore debt obligations | Collections or charge-offs severely harm your credit profile. |

Understanding your credit score is one of the most powerful tools for building long-term financial security. While it may seem like just a number, it reflects years of financial behavior and discipline. By paying bills on time, managing balances responsibly, avoiding unnecessary inquiries, and maintaining a healthy mix of credit, you can steadily improve your score. More importantly, by practicing these habits consistently, you can maintain a strong score that works for you throughout your financial journey.

A good credit score doesn’t just make borrowing cheaper—it builds the foundation for a more stable, less stressful financial life. Treat it as a priority, and the benefits will reach far beyond just your loans and credit cards.