Investing often feels like a world filled with complicated terms, endless options, and an intimidating amount of financial jargon. Yet for many Americans, mutual funds and exchange-traded funds (ETFs) have become the simplest and most accessible way to step into the market. Whether you are just starting your first job, saving for retirement, or simply hoping to grow your wealth beyond a savings account, understanding the basics of fund investing can help you make informed decisions.

What Are Funds and Why Do They Matter?

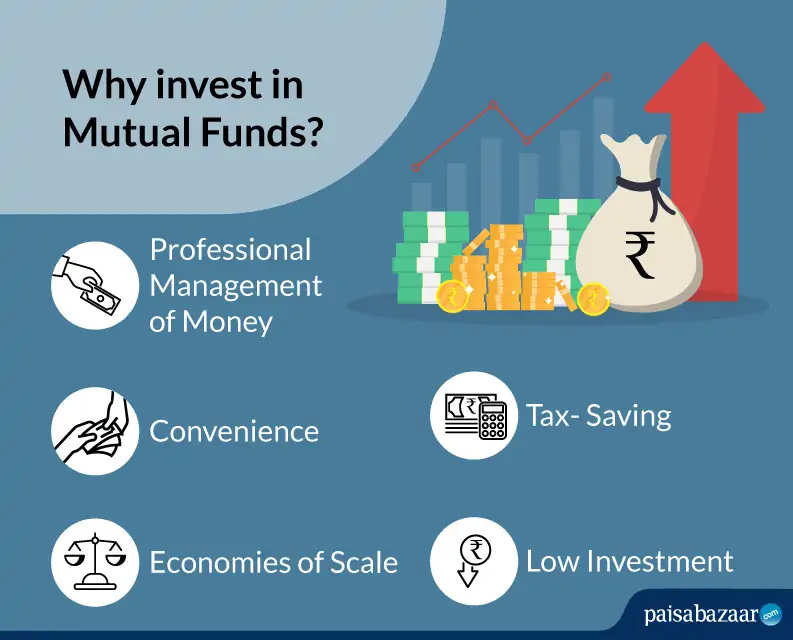

A fund, at its core, is a collection of investments pooled together from many individuals. Instead of buying stocks or bonds one at a time, you put money into a fund, and a professional manager or index strategy spreads that money across dozens or even hundreds of securities. This gives you diversification, meaning your risk is spread out rather than depending on the success of a single company.

For U.S. investors, funds come in two main forms: mutual funds and exchange-traded funds. Mutual funds are purchased directly from the fund company, often at the end of a trading day, and may come with fees or minimum investment requirements. ETFs, on the other hand, trade on stock exchanges like shares, giving more flexibility and often lower costs. Both types can track specific markets, such as the S&P 500, or focus on narrower themes like technology companies, bonds, or international markets.

Getting Started as a Beginner

For someone new to investing, the first step is understanding your own goals. Are you investing for short-term needs, such as a down payment on a home, or are you planning for retirement thirty years from now? Short-term goals often call for safer, bond-heavy funds or balanced options, while long-term goals benefit from stock-heavy funds that have higher growth potential, even if they come with short-term volatility.

Once your goals are clear, the next step is to choose an investment account. In the U.S., retirement accounts like 401(k)s and IRAs offer significant tax benefits, making them ideal starting points. Within those accounts, most employers and brokerages allow you to pick from a menu of funds. If you’re investing outside of retirement, a taxable brokerage account gives you complete flexibility to buy mutual funds and ETFs.

Costs, Risks, and Returns

One of the most important things to understand as a beginner is that not all funds are created equal. Some actively managed mutual funds charge higher fees because professional managers make buy and sell decisions. While this may sound appealing, research has shown that many active funds fail to beat the market consistently after fees are taken into account. On the other hand, index funds and ETFs usually come with very low expenses because they simply mirror a chosen market index. For beginners, low-cost index funds are often the most efficient way to start building wealth.

Risk is another essential factor. Stocks have the potential for higher returns, but they fluctuate more in the short term. Bonds are steadier but may grow more slowly. A well-diversified fund combines both, balancing growth and stability. The key is not to panic when markets fall. History shows that over long periods, U.S. markets have consistently recovered and grown, rewarding patient investors.

Building Confidence Over Time

The beauty of fund investing is that you do not need to be an expert in stock picking to succeed. By choosing a few diversified funds, automating contributions each month, and staying consistent, you can build wealth steadily over decades. Many investors start with a single broad-based index fund, such as one that tracks the entire U.S. stock market, and then expand into more specific funds once they are comfortable.

It is also important to review your portfolio regularly. Life circumstances change—marriage, children, buying a home, or approaching retirement all affect how much risk you should take. Rebalancing your funds every year or two ensures your investments match your goals and tolerance for risk.

The Bigger Picture

For beginners in the United States, investing in funds is less about chasing quick profits and more about building habits that last a lifetime. It requires discipline, patience, and an understanding that the market moves in cycles. Saving consistently, using tax-advantaged accounts, keeping costs low, and resisting the urge to make emotional decisions are the foundations of success.

A savings account may keep your money safe, but inflation erodes its value over time. By contrast, fund investments allow your money to grow with the economy itself. Whether it is helping you retire comfortably, pay for your children’s education, or simply give you more choices in life, learning how to invest in funds is one of the most valuable steps you can take toward financial independence.

Common Mistakes Beginners Make in U.S. Fund Investing

Stepping into the world of investing is exciting, but it can also feel overwhelming. For many Americans, mutual funds and exchange-traded funds (ETFs) are the first step into financial markets. They offer diversification, professional management, and accessibility. Yet even with these advantages, beginners often stumble into the same pitfalls. Understanding these mistakes can help you avoid costly lessons and build your investments with more confidence.

Confusing Short-Term Needs with Long-Term Investments

One of the most common mistakes is putting money meant for short-term needs into long-term funds. For example, if you’re saving for a vacation next summer or a house down payment in two years, the stock market is not the right place. Funds that hold stocks can swing widely in value, and a sudden market downturn could wipe out your savings right when you need them. Short-term money should stay in safer places like high-yield savings accounts or certificates of deposit. Long-term money, especially retirement savings, belongs in stock and bond funds where it has time to grow.

Ignoring Costs and Fees

Every fund comes with fees, and while they may seem small, they can add up significantly over decades. Many beginners pick actively managed funds because they sound sophisticated, but those often carry higher expense ratios. If a fund charges 1% annually, that means $1,000 out of every $100,000 invested is lost each year to fees, regardless of performance. Index funds and low-cost ETFs usually offer much lower expenses, which means more of your money stays invested and compounding over time.

Chasing Past Performance

It is tempting to look at a fund’s recent returns and assume the same success will continue. New investors often pile into funds that have been “hot” for the past year. The reality is that past performance is not a reliable indicator of future results. Markets are cyclical, and the best-performing funds one year may lag in the next. Instead of chasing returns, focus on funds that match your goals, risk tolerance, and time horizon.

Taking on Too Much or Too Little Risk

Risk is part of investing, but beginners often misjudge how much they can handle. Some take on too much risk by going all-in on aggressive stock funds without considering how they might react to a downturn. Others take too little risk by staying only in bond funds or money market funds, missing out on the growth potential of stocks. The right balance depends on age, income stability, and financial goals. Younger investors can typically afford to take more risk, while those closer to retirement need more stability.

Not Diversifying Enough

Even though funds already offer diversification, many beginners still concentrate too heavily in one area. For example, holding only a technology sector fund might feel exciting during boom years, but it leaves you vulnerable if that sector falters. Broad-based index funds or balanced funds spread your money across different industries, asset classes, and regions. True diversification reduces the impact of any single market downturn.

Timing the Market Instead of Staying Consistent

Beginners often try to predict when to buy or sell, waiting for the “perfect time.” This usually backfires because short-term market movements are unpredictable. Trying to time the market often leads to buying high and selling low. A better strategy is consistent investing—putting in money regularly, regardless of market conditions. This is often called dollar-cost averaging and is especially powerful when automated through payroll deductions or brokerage transfers.

Forgetting to Rebalance

Over time, the mix of funds in your portfolio will drift. For example, if stocks do very well, they might start making up 80% of your investments when your plan was to keep them at 60%. Without rebalancing, your risk level changes without you realizing it. Beginners often overlook this step, but rebalancing once a year brings your portfolio back in line with your intended strategy.

Neglecting Tax Implications

Taxes can quietly eat into your returns if you’re not careful. Holding funds in a taxable brokerage account means dividends and capital gains may be taxable each year. Beginners sometimes ignore tax-advantaged options like 401(k)s or IRAs, which allow investments to grow tax-deferred (or even tax-free in the case of Roth accounts). Placing the right funds in the right accounts is part of smart long-term planning.

The Bigger Lesson

Every beginner makes mistakes, but the most important thing is to keep learning and not let fear or early setbacks push you away from investing altogether. Fund investing is about patience and discipline. Avoiding these common missteps—chasing performance, ignoring costs, misjudging risk, and forgetting tax efficiency—can help you stay on track. Over time, steady contributions and a well-balanced portfolio are what build lasting wealth.