I’ve been in banking for close to four decades now. I’ve seen a lot—bank runs, economic booms, the rise of online banking, and now, a new wave: neobanks. Every time the banking world shifts, people ask the same question: “Is this better than what we had before?” And now, it’s “Should I go with a neobank or stick with a traditional bank?”

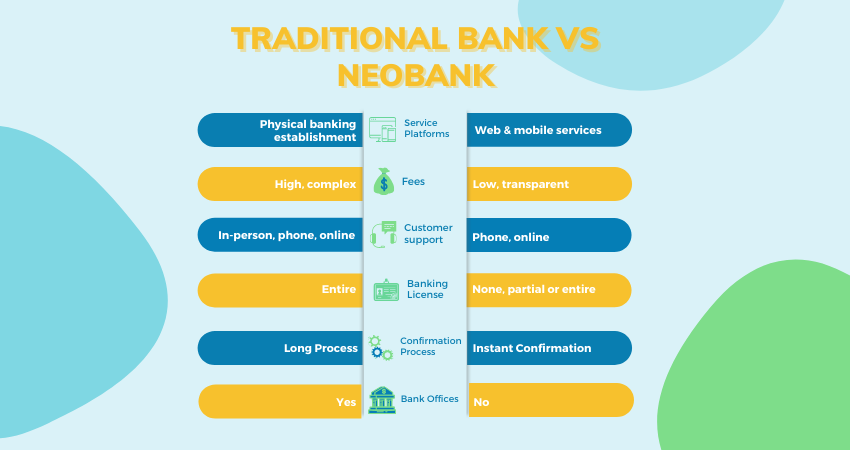

It’s a fair question, especially in 2025 when your bank no longer needs a building, or even a teller. A neobank can live entirely on your smartphone, with no branches, no physical paperwork, and no personal banker in sight. These banks are often slick, fast, and tech-heavy. They offer quick signups, early direct deposits, zero-fee accounts, and clean-looking apps that do everything from budgeting to investing.

But let me tell you something. The banking business—at its core—is about trust and relationships. Back in my day (and still today in some corners of Boston), people came into the branch not just to deposit a check, but to talk to someone. Someone who knew their story, remembered their father’s account, and would tell them flat out if they were about to make a mistake with a loan.

Now, I’m not here to trash neobanks. They’ve brought a welcome jolt to a slow-moving industry. They force traditional banks to rethink their bloated fees, outdated systems, and clunky user interfaces. And for young professionals, freelancers, gig workers, and digital nomads—people who don’t want or need face-to-face service—neobanks can be a blessing. The experience is usually smoother and faster than anything you’ll get from a legacy bank.

But that doesn’t mean they’re always the right choice.

Neobanks typically don’t have full banking licenses. Many partner with regulated banks in the background, meaning your money isn’t necessarily held by the company with the logo on your app. That’s fine for daily transactions, but if you’re talking about mortgages, small business loans, or long-term financial planning—well, that’s where traditional banks still hold the upper hand. When you need a banker who can actually get things done—bend a rule, speed something up, pick up the phone—you’ll find more value in a place with a physical presence and a deeper regulatory framework.

There’s also the matter of financial strength. A large regional or national bank isn’t going to vanish overnight. And while neobanks often have FDIC insurance through their partners, they’re newer players. Some of them are more fintech startup than stable financial institution. If one shuts down, your money is probably safe—but the hassle of switching, getting support, or resolving a dispute can be real.

I always tell folks: choose the bank that fits your life. If you’re in your twenties, don’t write checks, move often, and prefer texting to phone calls—why not go with a neobank? Just make sure you know who’s actually holding your deposits. If, on the other hand, you own property, have a growing family, run a small business, or simply value face-to-face advice, keep at least one foot in a traditional bank. There’s no harm in using both.

Banking has changed, and it will keep changing. But the fundamentals remain the same: you want your money safe, accessible, and working for you—not against you with hidden fees or poor service. Whether it’s on an app or across a teller’s desk, that’s what matters most.